PNB Recruitment 2024- पंजाब नेशनल बैंक(Punjab National Bank) ने विशेषज्ञ अधिकारी(एसओ) के पदों का नोटिफिकेशन जारी कर दिया गया है। […]

Limited Report

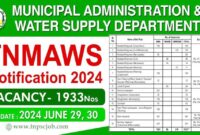

नगरपालिका प्रशासन और जल आपूर्ति विभाग में नौकरी पाने का शानदार मौका देखे आवेदन से जुड़ी सारी जानकारी

MAWS Recruitment 2024- नगरपालिका प्रशासन और जल आपूर्ति विभाग(Municipal Administration and Water Supply Department) ने इंजीनियर, इंस्पेक्टर और अधिकारी, सहायक […]

द न्यू इंडिया एश्योरेंस कंपनी लिमिटेड में निकली 300 से अधिक पदों पर भर्ती देखे आवेदन से जुड़ी सारी जानकारी

NIACL Recruitment 2024- द न्यू इंडिया एश्योरेंस कंपनी लिमिटेड(The New India Assurance Company Limited) ने सहायक के पदों का नोटिफिकेशन […]

उत्तराखंड उच्च न्यायालय में निकली नई भर्ती 22 फरवरी तक क्र सकते है आवेदन देखे पूरी जानकारी

UHC Recruitment 2024- उत्तराखंड उच्च न्यायालय(Uttarakhand High Court) ने कनिष्ठ सहायक, वैयक्तिक सहायक के पदों का नोटिफिकेशन जारी कर दिया […]

भारत डायनेमिक्स लिमिटेड में निकली 300 से अधिक पदों पर भर्ती देखे आवेदन से जुड़ी सारी जानकरी

BDL Recruitment 2024- भारत डायनेमिक्स लिमिटेड(Bharat Dynamics Limited) ने परियोजना अधिकारी, इंजीनियर और सहायक के पदों का नोटिफिकेशन जारी कर […]

राष्ट्रीय स्वास्थ्य मिशन में निकली नई भर्ती देखे आवेदन से जुड़ी सारी जानकारी

NHM Recruitment 2024- राष्ट्रीय स्वास्थ्य मिशन(National Health Mission) ने सामुदायिक स्वास्थ्य अधिकारी (सीएचओ) के पदों का नोटिफिकेशन जारी कर दिया […]

दिल्ली अधीनस्थ सेवा चयन बोर्ड में आवेदन करने का शानदार मौका देखे आवेदन से जुड़ी सारी जानकारी

DSSSB Recruitment 2024- दिल्ली अधीनस्थ सेवा चयन बोर्ड(Delhi Subordinate Services Selection Board) ने लोअर डिविजन क्लर्क (एलडीसी), जूनियर असिस्टेंट, स्टेनोग्राफर […]

होम गार्ड महानिदेशालय में निकली 10000 से अधिक पदों पर भर्ती 13 फरवरी तक क्र सकते है अपना आवेदन

DGHG Recruitment 2024- रेलवे नियुक्ति संस्था(Directorate General of Home Guards) ने होम गार्ड के पदों का नोटिफिकेशन जारी कर दिया […]

रेलवे नियुक्ति संस्था में निकली 5000 से अधिक पदों प भर्ती देखे आवेदन से जुड़ी सारी जानकारी

RRB Recruitment 2024- रेलवे नियुक्ति संस्थाRailway Recruitment Agency) ने सहायक लोको पायलट के पदों का नोटिफिकेशन जारी कर दिया गया […]

यूनाइटेड इंडिया इंश्योरेंस कंपनी में निकली नई भर्ती 23 जनवरी तक कर सकते है अपना आवेदन

UIIC Recruitment 2024- यूनाइटेड इंडिया इंश्योरेंस कंपनी(United India Insurance Company) ने प्रशासनिक अधिकारी के पदों का नोटिफिकेशन जारी कर दिया […]